It’s time again for another client letter to discuss what’s going on in the world nowadays. There’s enough confusion and frustration circulating that we thought some commentary would be helpful. Enjoy!

Dissecting this Bear

For those of you that have been following the markets this year, you know it’s been a pretty lousy year so far, but our team at HighPoint Advisors, LLC is here to help make sense of it. In this comprehensive note, I’ll examine the state of the markets. As of the beginning of November, the S&P 500 index is down a little over 20% year to date. And that performance includes a massive 8% rally for the month of October, taking us off the 2022 market lows! In this letter I’ll provide some color of what’s happened this year and what we may be able to expect going forward.

Where are we?

On November 2nd the Federal Reserve announced another 75 basis point (0.75%) increase in the federal funds rate. The federal funds rate is the interest rate charged to various banks on unsecured loans that are borrowed overnight, but it impacts the real economy because it influences how much consumers are charged to borrow as well as how much consumers are paid to save. This is what ultimately causes fluctuations in rates for things such as savings accounts, CD’s, mortgages, and credit cards, to name a few. And you’ve probably noticed that rates across the economy have gone up significantly this year! Rising rates have put real strain on the global economy – including companies, consumers and governments – and that has been a major contributor to many parts of the financial markets dropping into a bear market this year. A bear market is defined as a 20% drop from previous market highs.

How did we get here?

While not the only explanation, the markets of 2022 can simplistically be described as the aftermath of the COVID-19 pandemic. Robert Carey of First Trust explains that this bear market is “grounded in excess due to the trillions of dollars of monetary (Federal Reserve) and fiscal (Congress) stimulus injected into the US financial system to help mitigate the fallout from the COVID-19 pandemic.”

As a reminder of the sequence of events back in 2020: the COVID virus spread across the world, a pandemic began, work & lifestyles came to an abrupt halt for many, the global economy shut down, supply chains were severely disrupted, and then emergency measures were enacted in an effort to slow the damage. Interest rates were slashed to near zero, and large-scale purchases of government debt & mortgages ensued. These emergency measures, however, had a very serious consequence that was not easily quantifiable at the time: inflation.

The inflation we are now experiencing is the highest we’ve seen in 4 decades, and it grew from the seeds of both new money creation as well as from supply/demand dynamics. As a response to the COVID pandemic, the Federal Reserve and Congress turned the money printing press on high and left it there for a long time. Unprecedented stimulus packages were passed to put money in the hands of those that needed it most, and massive Federal Reserve security purchases kept the economy flush with liquidity. Even so, some industries were damaged beyond the point of recognition (think restaurants & travel) in-part because of labor issues. Meanwhile, some other industries experienced rapid growth (think video conferencing and other stay-at-home sectors) in-part due to the increased demand for technologies.

Unfortunately, inflation got a bit out of control – with the Consumer Price Index topping out at over 9% in June in the US – and so the Federal Reserve had to start to reverse course. While not their only actions taken, the Fed began to raise interest rates (as explained above) as well as begin to reduce their ongoing purchases in the treasury & mortgage securities markets. Historically, these measures can be very successful in quieting inflation, but they don’t produce results immediately. It takes time and persistence – which Fed chairman Jerome Powell keeps reminding us.

Are we at a bottom?

It’s just about impossible to call a market bottom, and I’m sorry to say that I will not do that in this letter. We do know that we’re in a bear market, so let’s start by looking at the types of bears. Bear markets essentially come in 3 flavors: Structural, Event Driven, and Cyclical.

Structural bear markets are generally caused by severe dislocations in the economy – typically in financial markets. Also, structural bears are often linked to “bubbles.” For example, a structural bear most people still remember is the 2008 Global Financial Crisis, which was comprised of numerous financial bad actors and a very famous real estate bubble. Event Driven bears, in contrast, are not specifically connected to financial related occurrences. They are usually triggered by an external and almost always unexpected shock. COVID-19 is a good example – a global health pandemic – that caused consumers and investors to quickly anticipate the immediate and heightened risks to the economy. Lastly, a Cyclical bear is a much more normal consequence of business cycles. More closely tied to the cycles of the economy, cyclical bear markets often coincide with a peak in corporate profit margins, high or rising inflation, rising interest rates, and/or deceleration in economic growth.

Currently, we find ourselves in a cyclical bear market. Hopefully you’ll agree that this is the least scary of the three types of bear markets, but nonetheless any 20%+ drop in the markets stings quite a lot. The good news is that the markets and the economy have worked through a lot of the painful symptoms that got us here, and we are starting to see signs of clearer skies ahead. That does not mean we have the “all clear” signal yet, but that things are improving.

To be sure, bear markets don’t tend to end until adequate selling in the markets creates attractive enough opportunities for many participants that are waiting on the sidelines to re-enter. That type of required capitulation sometimes shows up when market leadership changes, which just happened in late October this year when Big Tech stocks went from market leaders to laggards. We are also starting to see inflation numbers peaking. Global delivery times are back close to their long-run averages, commodity prices are off their highs, and wage growth looks as if it may be slowing. That matters greatly as the Fed has been struggling to reduce inflation all year, and has had to continue raising interest rates in response to continuously persistent incoming economic data. The projected ceiling of the federal funds rate has risen all year long (in lock step with rate hikes), and each new higher rate ceiling has essentially killed whatever would-be rally was happening in the markets at that time. There is unlikely to be any new bull market until the federal funds rate plateaus.

What can we expect going forward?

The markets still have some work to do before we are safely into the next bull market. News headlines are likely to continue in some key areas: the War in Ukraine, inflationary impacts, Chinese concerns ranging from COVID lockdowns to trade issues to the threat of invading Taiwan, the aftershocks of the US mid-term elections, among others.

Will we get confirmation that we’re actually in a recession? Some common recession signals have been present in 2022, including an inverted yield curve and sequential quarters of negative growth in the US. initially the yield on the 2 year treasury surpassed the yield on the 10 year treasury on April 1, which is called an inverted yield curve. That condition reversed briefly, but has been constantly inverted since early July. Additionally, GDP growth in the US was negative for both the 1st quarter (-1.6%) and the 2nd quarter (-0.6%) of this year. Both of those conditions are widely believed to be signs of a recession, but only the National Bureau of Economic Research can officially certify a recession. That organization uses several additional criteria in determining when there is a recession. These factors include such things as personal income, employment, consumption, retail sales and production. So we’ll have to wait and see how the data flows in.

Regardless of when or whether a recession is officially stamped into the history books isn’t what we should be focused on. Instead, what we should be watching is when inflation declines and how the Fed handles interest rates. In the current environment the futures markets are suggesting that the Federal Reserve may begin to cut rates around May of next year. That implies an expectation of lower inflation and more manageable economic conditions by then. That’s good news.

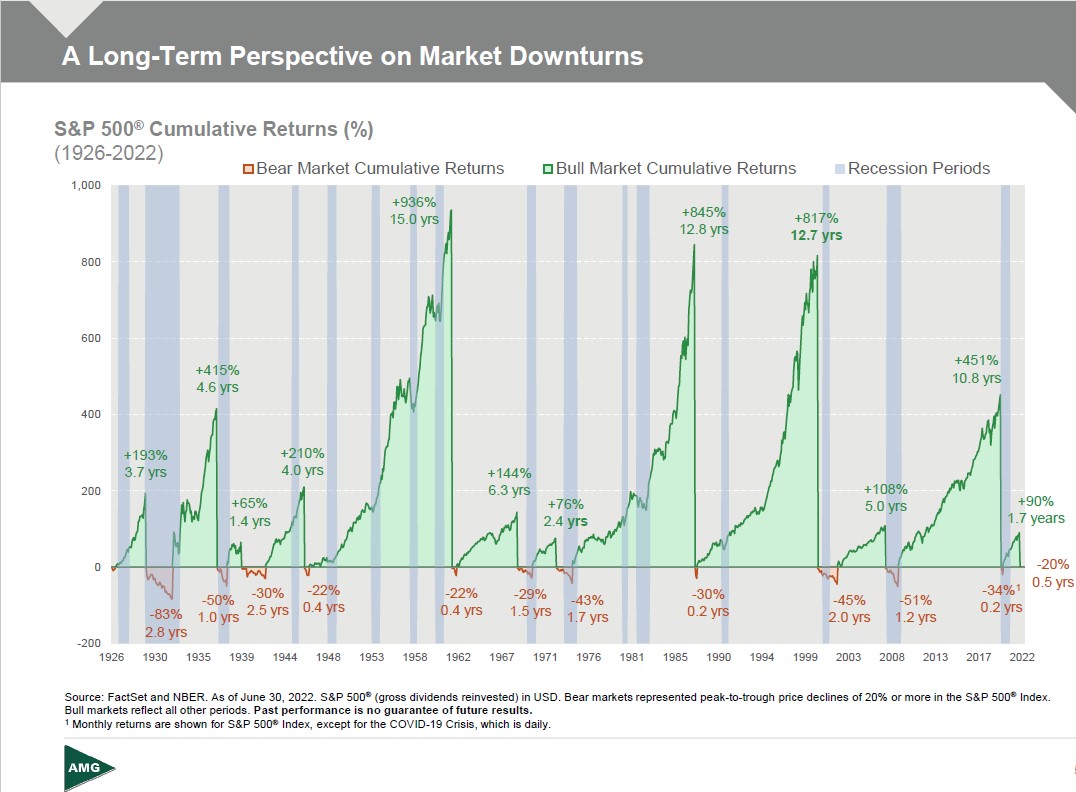

But be aware that short-lived bear market rallies may continue in the near term, as we’ve seen throughout this year. 2022’s market collapse has included 7 bear market rallies – with an average return of about 8% – since the market’s peak in January. Some of the reasons have involved optimism about economic growth, hopes of softer inflation, hopes of a softer Fed, and/or less-bad-than-feared corporate earnings reports. Historically, this is normal in these types of environments. What is much more exciting, however, is what comes after a bear market ends and a new bull market takes over. Massive gains off the bear market bottom! The chart below from AMG Funds shows returns data on the S&P 500 going back to the 1920’s. In particular, it shows the amount the market dropped in bear markets, and then the magnitude of subsequent gains in the ensuing bull markets. Hopefully, you will immediately appreciate the fact that bull markets more than make up for any temporary drops during preceding bear markets – by a long shot. Further, I’ll point out that economic expansions on average last about 7x longer than the recessions that precede them. So better times are surely ahead!

In closing, I’ll offer a few words of advice: hang in there. Trust your plan that you’ve created with us, trust the process, trust history. Bear markets come and go. Don’t allow yourself to succumb to emotion, and don’t abandon your plan. We’re not advocating to set-and-forget your portfolios, but rather to stay the course and let your plan work. The markets are in a bottoming process, and future returns after a bear market bottom are usually very strong for an extended period of time. Of course, if your situation has changed then please let us know right away and we’ll adjust as needed, but now is not the time to make decisions that will go against your needs. Continue to invest, or consider making new contributions if you can. We won’t call today a bottom (because we don’t have a crystal ball), but buying the markets at a 20%+ discount is usually not a bad idea long-term.

Please reach out to your advisor at the HighPoint Advisors, LLC office to chat more if you need.

As always, thank you for your trust and confidence.

Adam (AJ) Loedel, CFP®, ChFC, RICP, LUTCF

Managing Director

HighPoint Advisors, LLC

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. “Securities offered through LPL Financial. Member FINRA/SIPC. Investment advice offered through Private Advisor Group, a registered investment advisor. Private Advisor Group and HighPoint Advisors are separate entities from LPL Financial. RIPC conferred by The American College. The information contained in this email message is being transmitted to and is intended for the use of only the individual(s) to whom it is addressed. If the reader of this message is not the intended recipient, you are hereby advised that any dissemination, distribution or copying of this message is strictly prohibited. If you have received this message in error, please immediately delete.”