The modern economic climate places many young professionals face to face with unique financial challenges. Many find themselves weighed down by debts as they struggle with the rising cost of goods and services. It’s no surprise that a large amount feel like their income simply isn’t enough to get ahead. From student loan debt to rising living costs, it can feel overwhelming to manage finances effectively. However, with the right mindset and a few smart budgeting strategies paired with some disciplined behaviors, it’s possible to gain control of your personal finances. Managing expenses and reducing debt are a few key ways to begin paving the way for a secure financial future.

HighPoint Advisors, LLC has been helping clients at all stages of their careers and lives get a handle on their financial future. Serving clients in Syracuse, NY as well as cities across the country, we provide guidance on budgeting, debt reduction, income planning, as well as many other areas of financial planning for young professionals.

Here are some essential budgeting tips and best practices to help you set yourself up for long-term financial success.

Budgeting: Track your Spending

A crucial place to start is to build a solid, realistic budget. Begin by listing all sources of income and essential expenses. Expenses could include rent, transportation, utilities, groceries, job expenses, and loan payments (to name just a few). Meticulously track spending for a few months to identify where your money goes and where adjustments can be made. Even small adjustments—like cooking at home instead of getting takeout —can free up cash for savings or debt reduction. There are also free finance and budgeting apps out there, or you could create a simple spreadsheet to categorize and track your activity.

Next, subtract expenses and taxes from pre-tax income, and the result is your discretionary income (otherwise known as what you have to work with). Once you know how much excess cash flow you have to work with, then decide where to direct those dollars. This excess income should go towards things like saving for your future or reducing your outstanding debts.

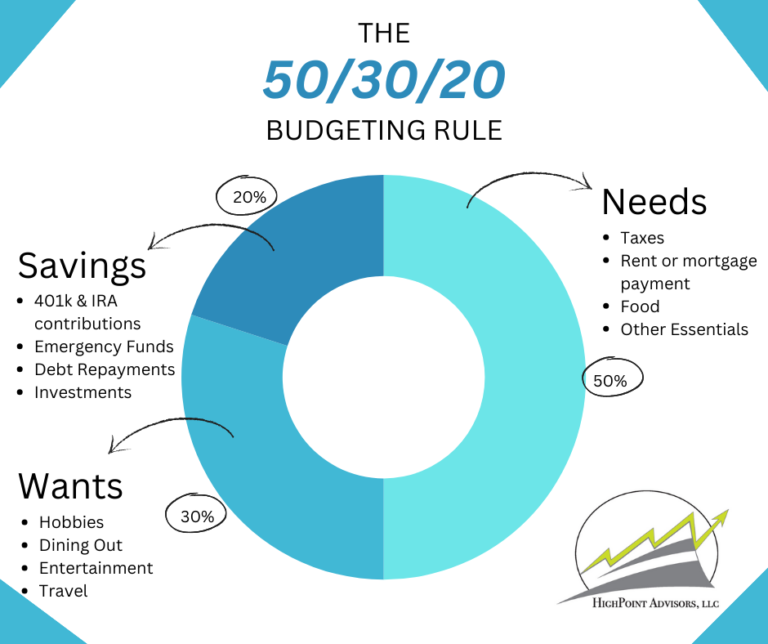

An alternate popular approach is generally called the 50/30/20 rule. Simply stated: allocate 50% of your gross income to needs, 30% to wants, and 20% to savings and debt repayment. This is just an example, not a rule. Needs include things like taxes, rent, food, transportation, and other essentials. Wants include things like hobbies, dining out, entertainment, and travel. Savings and debt reduction includes contributions to a 401k or other retirement account, Roth IRA contributions, creating an emergency fund, payments on student loans, paying off credit cards, and managing auto loans.

Reduce your Expenses

Reducing non-essential spending doesn’t have to mean missing out on everything. Here are a few ways to trim costs without sacrificing lifestyle too much:

- Dining out: Limit eating out to special occasions or once a week instead of multiple times. You don’t have to be a chef to cook at home, and it can save hundreds of dollars each month.

- Shop for deals: Buy big ticket items around major holidays when sales occur, or use coupons.

- Streaming services: If you have multiple subscriptions, consider rotating services every few months or sharing plans with family or friends.

- Free entertainment: It’s not hard to find low cost, or free, entertainment in your area. Things like concerts, festivals, dog parks, hiking trails are available options at little or no cost.

- Transportation: If possible, walk, bike, or take public transportation. If you drive, consider carpooling to reduce costs for you and your peers.

- Negotiate bills: Services like internet, mobile phone, car insurance, and other subscriptions are all adjustable. Asking for a better rate or discussing what you’re actually paying for can lead to savings.

- Consolidate or refinance debts: high-interest credit card or other debt can be transferred to a better card or loan, reducing interest charges and payments. Another option is to refinance an existing loan, if better deals exist now.

Small changes like these can create significant savings that you can redirect toward debt repayment or saving for future goals.

Automate and Maximize Savings

Saving is tough when dealing with tight budgets, but automation can make it much easier. Start small if needed — aim to save 5% to 10% of your income — and increase your contribution rate over time.

Some younger clients prefer to direct a portion of their paycheck to go directly into a separate savings or investment account each month. Some find comfort in this “pay yourself first” approach, which ensures that savings happen consistently. Set up automatic transfers to your savings accounts for bill payments and other recurring expenses. This ensures you’re consistently saving and avoiding late fees. It also reduces the temptation to spend money that should be allocated to savings or essential expenses.

If you’re offered a 401(k) Plan with matching contributions through your employer, contribute at least enough from each paycheck to receive the full match. This is essentially free money that can significantly boost your long-term savings. On top of a retirement plan at work, consider making automated contributions to a Roth IRA. This can be another tax-advantaged essential tool for future financial independence. Even if you can’t max out your contributions to various investment accounts initially, start with what you can afford and gradually increase your savings rate over time.

Build an Emergency Fund

Unexpected things happen, and having a financial safety net is crucial. Having even three to six months’ worth of living expenses saved in an easily accessible savings account can be a major lifeline in uncertain times, or if a crisis happens. Start small, if necessary, but make consistent contributions. This fund will provide peace of mind and prevent you from accumulating debt when unexpected expenses arise. In other words, an emergency fund could end up saving your overall financial plan.

Stay Focused on Debt Repayment

Focus on paying off credit card balances and other high-interest loans as quickly as possible, as the interest charges will significantly slow your progress.

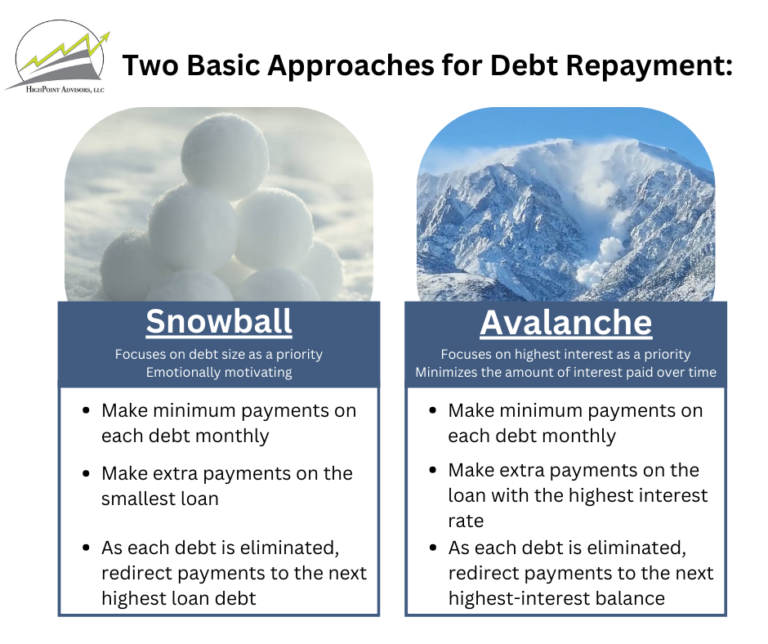

There are two basic approaches to pay down these balances:

- Debt avalanche / Interest rate arbitrage: Prioritize paying off the debt with the highest interest rate first, then work your way down to lower-rate debts. As you eliminate each debt, redirect those payments to the next highest-interest balance. This approach minimizes the amount of interest paid over time.

- Debt snowball / Psychological victory: Pay off the smallest debt first, regardless of the interest rate, and then roll that payment into the next debt. This method can be emotionally motivating, as the quick wins encourage you to stick with the plan.

Whichever method you choose, always make it a priority to consistently pay more than the minimum to reduce debt faster.

Small Steps Add Up Over Time

Sticking to a budget, reducing debt, and prioritizing savings might seem difficult initially, but having discipline will pay

dividends down the road. Good habits now will bring financial freedom later. Remember, it’s about being consistent – small steps will accumulate over time.

While budgeting might seem focused on the short term, having clear goals is essential for long-term success. So, what are your goals? Maybe buying a home, traveling, or retiring early? Set small, measurable goals that bring you closer to that vision and have the patience and perseverance to reach them. Goals give purpose to your budget and help you stay motivated during challenging times.

Consider consulting with a financial advisor to help develop a personalized plan, especially if you’re balancing debt with savings and investments. At HighPoint Advisors, LLC, our advisors can help you create a comprehensive financial plan tailored to your specific situation and goals.

Get start today! Contact Us and you’ll be on your way to greater financial freedom and security.